I got a request from foreign residents in Japan.

He wanted to know about will / testament, so today, I will explain about how to make your will over your properties such as real estate or savings in Japan and overseas.

In general, you can leave your will in Japan, too.

(1)

Firstly, to make an effective will, you have to make it in proper procedure.

What do you mean by “proper procedure”?

As long as you make your will in accordance with the laws as follows, your will is regarded as being made under proper procedure.

・Your national law of when making your will

・Law of your domicile of when making your will

Therefore, it would be no problem if your will meet the procedures of the laws of your country or Japanese.

However, with regard to the properties in Japan, it would be better for you to make it in accordance with Japanese law, because there is a possibility of being complicated when you make it in your national law.

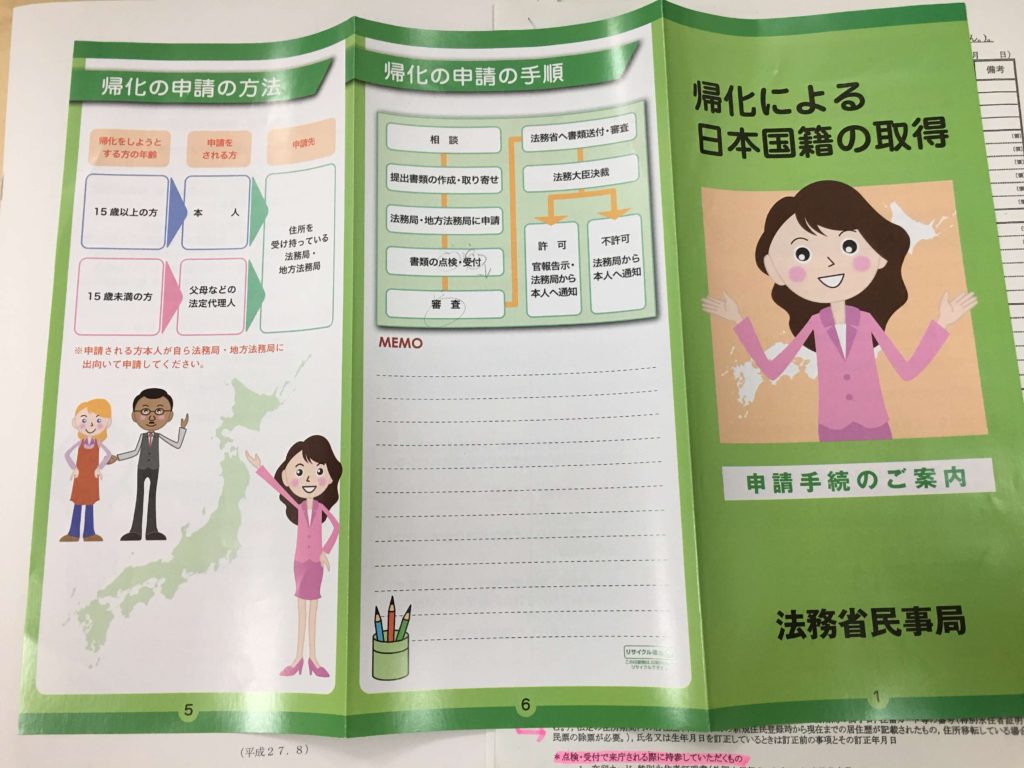

That is to say, the persons concerned such as legal affairs bureau or banks might not understand easily when executing your will.

The Japanese civil law stipulates 3 forms of will as follows.;

・Holographic will

・Will by Notarized Document

・Will by Sealed and Notarized Document

In my opinion, I suggest you should take the form of Will by Notarized Document because you can consult with notary on the effectiveness and contents of your will.

Although it takes time and costs, you can say that Will by Notarized Document is the form that there is low possibility of invalidity.

Since you must make this in Japanese, if you are unable to read and write in Japanese, you have to be with your interpreter.

And also, you have to prepare your alien registration certificate and passport.

(2)

After taking proper procedure, secondly, you have to confirm the matters as follows;

・The effectiveness of the will ( the matters of testamentary capacity, miscomprehension or cancellation of your intention )

・Effectuation of your will

・The effectiveness of the contents of your will

As for these matters, the law stipulates as follows;

1.The effectiveness and effectuation of the will is based on the law of the country where the testator had nationality.

2.Inheritance shall be governed by the national law of the decedent.

Therefore, these matters are judged by the national law of the testator.

(3)

With regard to the properties that you have overseas, though the Japanese court judged your will as effective, whether your will is approved or not must depend on the law where your properties are located, because the execution will be done in there.

Therefore, by consulting with a local attorney, I think it would be better for you to prepare another will based on the law of that country in addition to the will based on Japanese law with regard to the overseas properties.

If you have any questions, please feel free to ask.

Thank you.

Solicitor Hitoshi Oishi (司法書士 大石人士・おおいしひとし)