Hello.

I am Hitoshi.

Thank you for always coming to my page.

Today, before starting explaining about actual flow of making GODO kaisha, I explain about “What is the difference between GODO kaisha and KABUSHIKI kaisha?”

The last time, I said, “KABUSHIKI kaisha is not the only company form in Japan.”

KABUSHIKI is one of the forms of company.

In my opinion, since most of your business size is small at the beginning, I recommend that you start from GODO kaisha.

If you are the only member of your company, there is no big difference between KABUSHIKI and GODO.

Even when your company size is big, you can choose GODO kaisha, of course.

For example, these companies are GODO kaisha.

Now, let’s check the differences one by one.

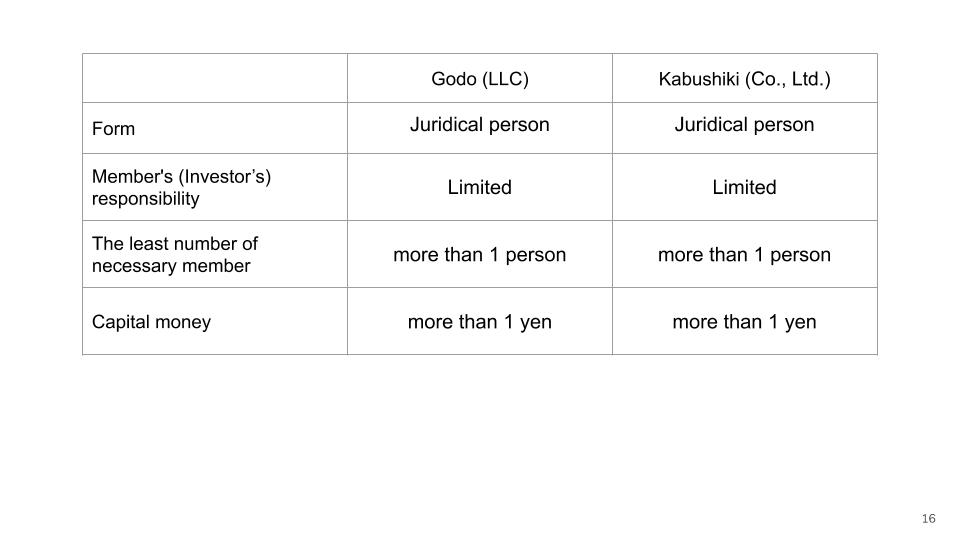

As to form, both are juridical person.

So you can use your company as the subject of a contract in real trade.

As to member’s responsibility,

it is limited up to capital money or the amount of share, technically.

As to least number of necessary members, in GODO and KABUSHIKI, more than 1 person is necessary. So, you can start it alone.

As to capital money, in both cases, more than 1 yen is necessary.

However, as to business visa, you need to invest 5 million yen at least.

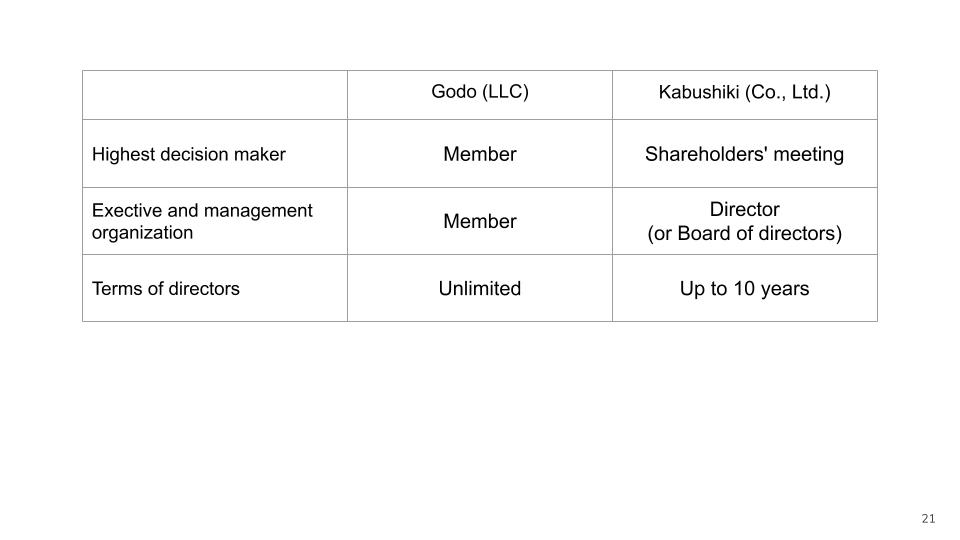

As to highest decision maker, in GODO, member is the supreme decision maker, whereas, in KABUSHIKI, shareholder’s meeting is the highest.

As to executive and management organization, in GODO, member is the operator of the company, and in KABUSHIKI, director or board of directors is executive organization.

As to terms of directors, in GODO, unlimited, and in KABUSHIKI, up to 10 years.

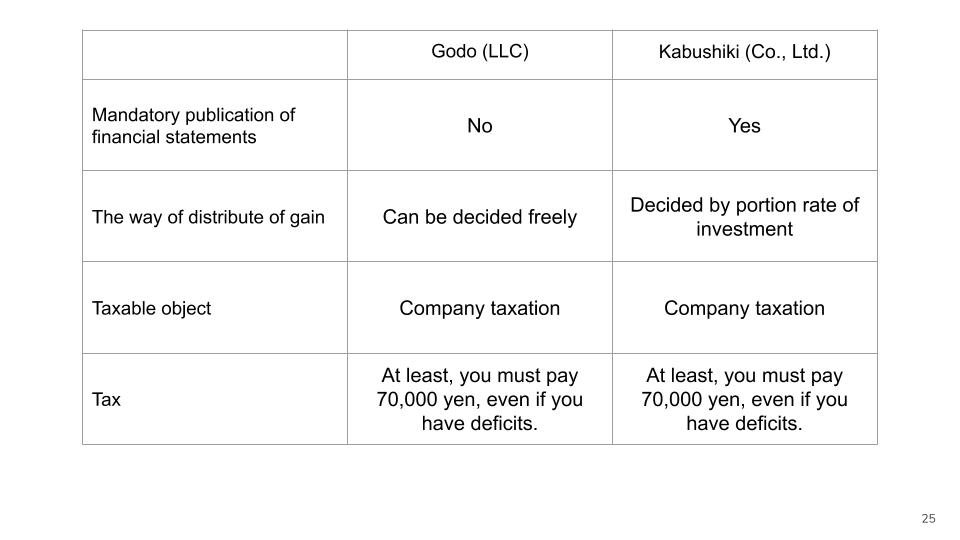

As to mandatory publication of financial statements, in GODO, no need to go public it, whereas in KABUSHIKI, it is mandatory.

As to the way of distribute of gain, in GODO, it can be decided by freely, and in KABUSHIKI, it is decided by portion rate of investment.

As to taxable object, in both forms, company is the object of taxation.

Of course, they will also impose income tax on your own salary as company director.

As to tax, in both cases, even if your company has deficits, at least you need to pay 70,000 yen as corporate tax.

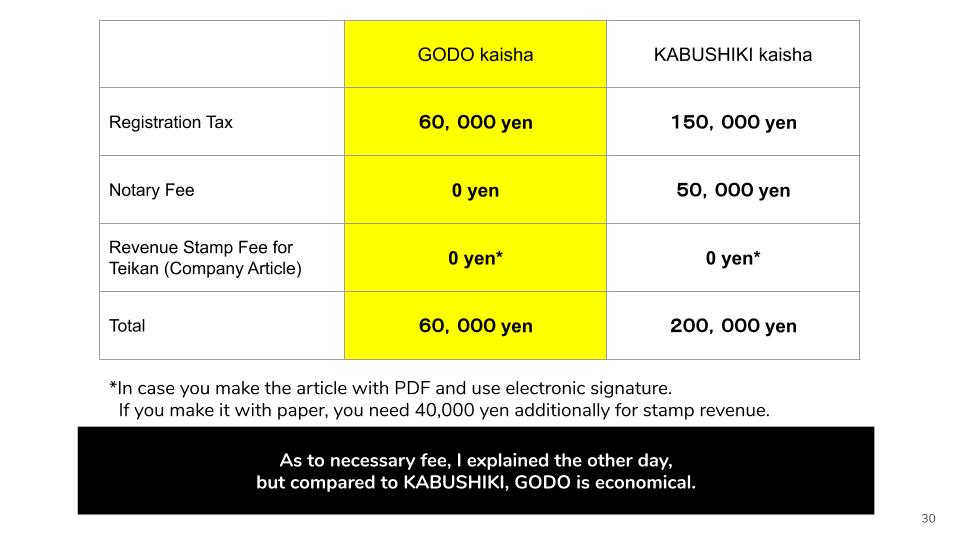

As to necessary fee, I explained the other day, but compared to KABUSHIKI, GODO is economical.

That’s all today.

For your reference, and I hope this will help you.

(PR) As to HANKO

You can get company seal and square seal in one set through this link.

As to application form, unfortunately, there is no foreign language version, so, if you need to apply, please let me know.

I will apply for it on behalf of you.